Car loan interest rate 2025

18+

Partner financial institutions.

1000+

What to Expect from Interest Rates for Good Credit in 2025

In 2025, financial institutions continue to offer interest rate competitive for borrowers with good credit. As the chart above shows, interest rates offered by major institutions such as Desjardins, National Bank, Royal Bank, TD Bank, CIBC And Scotia Bank are generally between 7.99 % and 8.99 %. These rates are indicative of current market conditions, influenced by several economic and political factors.

Factors influencing interest rates

- Monetary policy: Central banks, such as the Bank of Canada, adjust their policy rates to control inflation and stabilize the economy. This directly affects the rates offered to consumers.

- Credit profile: Good credit gives access to more advantageous rates. Financial institutions consider a good credit record as a sign of reliability, which translates into more favorable loan terms.

- Competition between institutions: As shown in the graph, rates vary slightly between institutions. This is explained by the competitive strategies of each bank to attract customers.

What to expect for good credit?

In 2025, borrowers with good credit can expect to get interest rates towards the lower end of this range (around 7-8%, or %). However, these rates may fluctuate slightly depending on:

- There length of loan term (for example, a 5-year fixed rate car loan might have a slightly higher rate than a short-term loan).

- Seasonal promotions or offers specific to each institution.

Tips for getting the best rates

- Maintain a good credit record: A credit score High credit and a history of regular payments are essential to access the best rates.

- Compare offers: Evaluate the proposals of several financial institutions in order to choose the one that best suits your needs.

In summary, borrowers with good credit in 2025 can expect competitive interest rates. Staying informed about economic trends and comparing offers between institutions is the key to maximizing your financial benefits.

* The proposed interest rate may vary considerably depending on several factors, including the financial institution chosen, your credit file, as well as the model, make and year of the vehicle. The graph presented is for informational purposes only and in no way guarantees obtaining such a rate. This is a hypothetical analysis intended to illustrate current market trends.

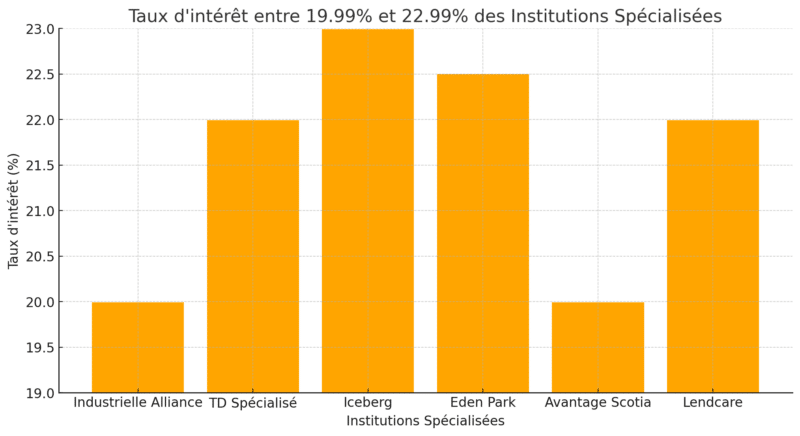

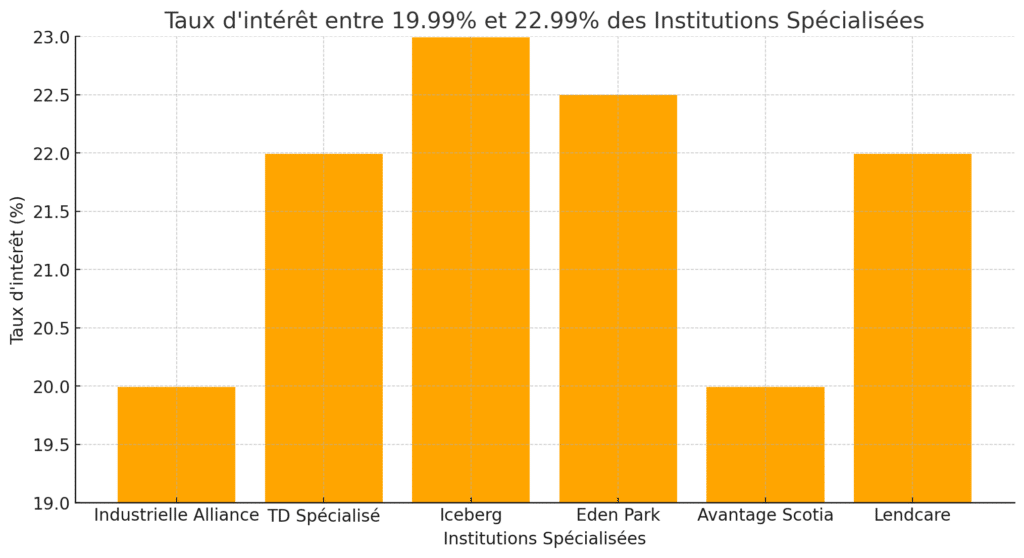

In 2025, borrowers with bad credit face unique challenges when it comes to getting a car loan. Interest rates for this type of profile are generally higher than for standard credit, but options remain available through specialized financial institutions such as Industrial Alliance, Eden Park, Iceberg, Scotia Advantage, Lendcare and TD Specialized.

Why are rates higher for bad credit?

Financial institutions view borrowers with a bad credit history as presenting an increased risk of non-repayment. This risk is offset by higher interest rates, which allow lenders to protect themselves in the event of default of payment. So, bad credit rates in 2025 are generally in the range of $19.99 to $22.99, as shown in the chart above.

Interest rates of specialized institutions

Specialized financial institutions offer solutions tailored to borrowers with bad credit. Here are the typical rates observed for these lenders in 2025:

- Industrial Alliance : 11.90% to 29.99 %

- Specialized TD: 11.90% to 29.99 %

- Iceberg: 11.90% to 29.99 %

- Eden Park: 11.90% to 29.99 %

- Scotia Advantage : 11.90% to 29.99 %

- Lendcare: 11.90% to 29.99 %

These institutions are distinguished by their ability to work with financial profiles varied, including those with a history of bankruptcy, of the consumer proposals or some late payments.

What You Need to Know Before Taking Out a Car Loan

- Compare options: Even with bad credit, it is possible to compare offers between different specialized institutions to find the most advantageous rate.

- Improve your financial profile: Before taking out a loan, it is recommended to improve your credit file by making regular payments and reducing your debts. There debt consolidation may be an interesting possibility.

- Consider the total cost of the loan: A high interest rate means higher monthly payments and a higher total cost. It is essential to evaluate its repayment capacity before committing.

* The proposed interest rate may vary considerably depending on several factors, including the financial institution chosen, your credit file, as well as the model, make and year of the vehicle. The graph presented is for informational purposes only and in no way guarantees obtaining such a rate. This is a hypothetical analysis intended to illustrate current market trends.

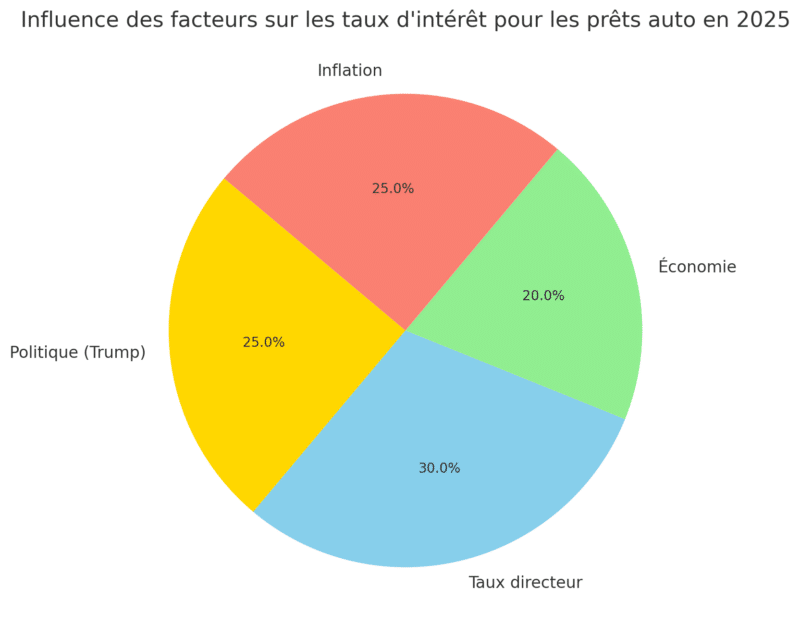

How Markets Will Affect Your Car Loan Interest Rates in 2025

Auto loan interest rates in 2025 are directly influenced by a multitude of economic and political factors. These variables shape the financial landscape, affecting the cost of borrowing for consumers. Some of the key drivers of interest rates this year include the impact of politics, including Donald Trump, policy rate adjustments, broader economic trends, and inflation dynamics.

1. The impact of politics, especially Donald Trump

Even after his term, Donald Trump remains an influential force in American politics, and his actions can indirectly affect interest rates in Canada. If Trump plays a major role in the 2024 U.S. elections or initiates protectionist economic policies, it could lead to disruptions in U.S.-Canada trade relations. These disruptions could impact economic stability and influence the interest rates charged by Canadian financial institutions. Increased political uncertainty often prompts banks to adjust their rates to offset risks associated with market fluctuations.

2. The role of the key rate

THE key rate, The Bank of Canada’s policy rate, set by the Bank of Canada, is one of the most powerful levers for influencing interest rates. In 2025, this rate continues to be adjusted to balance economic growth and inflation. A high policy rate increases borrowing costs for banks, which directly impacts consumers, including those looking to finance a car loan. Conversely, a lower policy rate can stimulate borrowing by making loans more accessible. The Bank of Canada’s decisions are often influenced by global economic conditions and domestic economic performance.

3. The state of the global and Canadian economy

In 2025, the global economy remains a key factor in determining interest rates. Economic growth in Canada, combined with international events such as geopolitical conflicts, the recovery or slowdown in industrial production, or changes in oil prices, plays an important role. A strong economy encourages higher interest rates, as lenders perceive a greater ability to repay among borrowers. Conversely, during an economic downturn, rates are often lowered to encourage borrowing and stimulate activity.

4. The dynamics of inflation

Inflation remains a significant challenge for policymakers. High inflation pushes central banks to raise interest rates to contain rising prices. This translates into higher borrowing costs, directly affecting auto loans. On the other hand, if inflation is controlled or declines, interest rates may remain stable or even decline. Inflation is being closely monitored in 2025, especially after the fluctuations of previous years caused by supply chain disruptions and global economic interventions.

What This Means for Your Car Loan in 2025

In summary, auto loan interest rates in 2025 are the result of a complex interplay between economic policies, central bank decisions, and global economic dynamics. Here’s what you need to remember:

- Global political and economic decisions, such as those influenced by Donald Trump, can play an indirect but significant role on rates.

- The policy rate remains a key indicator to watch, as it determines the basic cost of borrowing.

- The state of the economy and fluctuations in inflation largely dictate interest rate trends.

Here is a pie chart graph illustrating the major factors influencing auto loan interest rates in 2025. The proportions show the relative importance of the following:

- Politics (Trump) : 25 % Key rate : 30 % Economy : 20 % Inflation : 25 %

How Prêt Auto Québec can help you get the best interest rate in 2025 for your car loan

In 2025, getting the best interest rate for a car loan can seem complex, especially with economic fluctuations and the different offers from financial institutions. This is where Prêt Auto Québec steps in as a trusted partner to simplify the process and maximize your benefits.

1. A vast network of financial partners

Prêt Auto Québec works with a wide range of financial institutions, including banks, specialized lenders such as Industrial Alliance, Eden Park, Iceberg, Advantage Scotia, Lendcare, and specialized divisions such as TD Specialized. Thanks to this network, we can offer you competitive rates adapted to your profile, whether you have excellent credit or financial challenges to overcome.

2. Solutions adapted to all types of credit

We understand that every customer is unique. Whether you have good credit, bad credit or are in a situation of second chance, third chance or fourth chance credit, Prêt Auto Québec finds personalized solutions. We analyze your situation to identify the best possible options, even under high interest rate conditions.

3. Expert negotiation to get you the best rate

With our market expertise and knowledge of financial institutions, we negotiate on your behalf to obtain the lowest possible interest rate. We leverage our experience and negotiating power to offer you advantageous conditions.

4. An understanding of market trends

Interest rates are influenced by several factors, such as politics (including economic impacts related to figures like Donald Trump), the key rate, the state of the economy and inflation. At Prêt Auto Québec, we monitor these trends to advise you at the right time, allowing you to take advantage of the most favorable conditions.

5. A transparent and simple approach

Our mission is to make the financing process simple and transparent. We clearly explain the available offers, repayment terms and total costs associated with your loan, so you can make an informed decision.

Why choose Prêt Auto Québec?

- Local expertise: We understand the specific needs of Quebecers and have in-depth knowledge of the province’s financial institutions.

- Speed and efficiency: Our team ensures that your financing request is processed quickly so that you can get back behind the wheel of your vehicle without delay.

- No hidden costs: We offer you complete transparency on the costs of your loan.

Conclusion

With Prêt Auto Québec, you have access to tools, advice and a network that allow you to obtain the best interest rate for your car loan in 2025. Contact us today to discuss your needs and let us guide you towards a financial solution adapted to your situation.

Get your car loan now.

We can help you.

To reach us by phone, dial:

info@www.pretautoquebec.ca