Canada Prime Rate

18+

Partner financial institutions.

1000+

Definition and role of the director

What is the Bank of Canada's policy rate?

The policy rate is the interest rate that the Bank of Canada charges major financial institutions for short-term loans. This rate serves as a benchmark for many other interest rates in the economy, including mortgages, personal loans, and car loans. It is a key tool used by the Bank to maintain economic stability, control inflation, and influence economic growth.

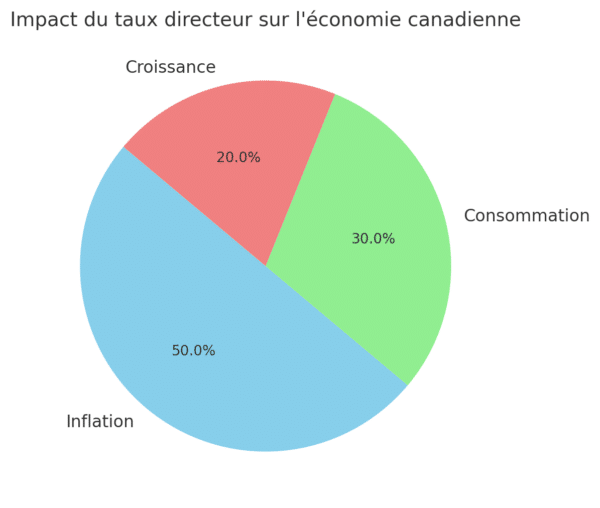

Its impact on the Canadian economy: inflation, consumption and growth

The policy rate affects three fundamental aspects of the economy:

- Inflation: By raising the policy rate, the Bank of Canada curbs spending and borrowing, which reduces inflationary pressure. A lower rate encourages borrowing and can stimulate demand.

- Consumption: A low policy rate encourages consumers to borrow and spend, thereby increasing demand in the economy. Conversely, a high rate reduces household spending.

- Economic growth: Businesses borrow more to invest when interest rates are low, which stimulates economic growth. Conversely, high rates can slow investment and limit growth.

How the policy rate influences the interest rates of banks and financial institutions

The policy rate acts as a basis for determining the interest rates applied by financial institutions:

- When the policy rate rises, banks raise their interest rates on loans, making borrowing more expensive for consumers and businesses.

- When the policy rate falls, banks lower their rates, making borrowing more accessible and thus encouraging consumption and investment.

In summary

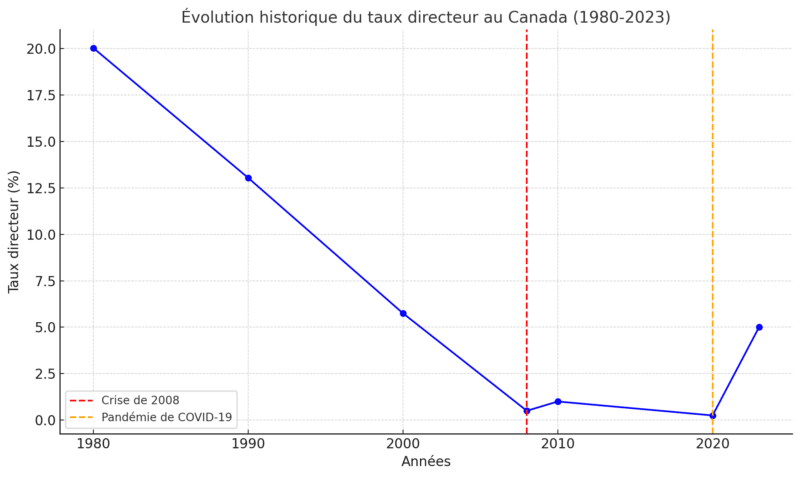

The Bank of Canada's policy rate has evolved significantly over the decades, reflecting economic conditions, global crises and monetary policy objectives. This section explores trends, the impacts of economic crises and international comparisons to better understand its role in the Canadian economy.

1. Trends of recent decades and their main causes

- 1980s: This period was marked by high policy rates, reaching over 20 % in 1981, in an attempt to combat galloping inflation. The main objective was to stabilize prices in a period of strong economic pressure.

- 1990s: Rates gradually declined as inflation was brought under control, and the Bank of Canada adopted an inflation targeting policy (between 1 % and 3 %).

- 2000s: With a relatively stable economy, policy rates hovered around 4 % to 5 %. However, the 2008 financial crisis led to a rapid rate cut to stimulate the economy.

- 2010s: Rates remained low to support a prolonged economic recovery from the 2008 crisis. By the end of the decade, they rose slightly in response to more robust economic growth.

- 2020 and beyond: The COVID-19 pandemic led to historically low rates, reaching 0.25 %, to encourage investment and consumption amid an economic slowdown.

2. The impacts of economic crises on the key rate

- 2008 crisis: The global recession prompted the Bank of Canada to quickly lower the policy rate to counter the economic contraction. The reduction was aimed at stimulating credit, household spending and business investment.

- COVID-19 pandemic (2020–21): In response to an unprecedented economic crisis, the Bank of Canada reduced the policy rate to a record low of 0.25 %. This accommodative policy stance was intended to support households and businesses affected by income losses, while facilitating access to credit to maintain a measure of economic stability.

- Post-pandemic energy crisis and inflation (2022-2023): With a strong economic recovery and rising inflation, the Bank of Canada raised rates rapidly, reaching 5.% in 2023, to slow demand and stabilize prices.

3. Comparison with policy interest rate policies in other countries

- United States: The Federal Reserve adopts similar policies, but with variations based on national priorities. Adjustments to U.S. policy rates often influence the Bank of Canada's decisions, given the close economic ties between the two countries.

- Europe: The European Central Bank (ECB) generally keeps rates lower due to economic challenges specific to the eurozone, such as stagnation and sovereign debt crises.

- Asia: Countries like Japan and China are taking different approaches. Japan, for example, has kept rates near zero for decades to counter chronic deflation, while China is adjusting its policies to promote rapid growth while controlling inflation.

These comparisons show that Canada adjusts its policy rate based on its own economic realities, while taking into account global dynamics to remain competitive on the international market.

In summary

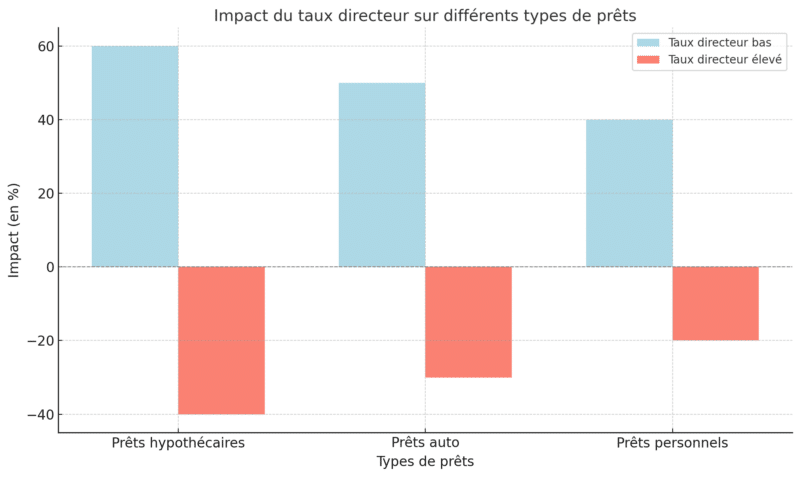

The impact of the policy rate on loans and credit

The Bank of Canada’s policy rate is one of the key economic levers that influence borrowing costs for consumers and businesses. Its changes directly affect mortgage, auto, and personal loan rates, changing consumption and investment dynamics. Here’s a detailed exploration of its impact and strategies to take advantage of it.

1. Influence on mortgage, auto and personal loan rates

- Mortgages:

The policy rate directly influences variable mortgage rates. An increase in the policy rate results in higher monthly payments for those with a variable rate mortgage. For fixed rate mortgages, changes in the policy rate affect new loans and renewals, making them more expensive when rates rise. - Car loans:

Auto loans are also impacted by the policy rate, especially for borrowers with variable rate financing. A rise in the policy rate increases the total cost of financing, making monthly payments higher for new buyers. Discounted promotional financing offers also become less common when the policy rate is high. - Personal loans:

Variable-rate personal loans follow changes in the policy rate. An increase results in higher payments, which can limit access to credit for some borrowers. Fixed-rate loans are less directly affected, but financial institutions typically adjust their offerings in response to overall rate trends.

2. How changes in the policy rate affect consumers and businesses

- Consumers:

A rise in the policy rate makes borrowing more expensive, reducing households' ability to buy. This can slow spending on items such as homes, vehicles or electronics. Conversely, a low policy rate encourages borrowing and consumption because interest payments are lower. - Companies:

Businesses are also affected by changes in the policy rate. Rising rates make business loans more expensive, which can hamper investments in growth, such as purchasing equipment or expanding operations. In addition, higher borrowing costs can lead to price increases to compensate for reduced margins.

3. Strategies to take advantage of a low policy rate or manage increases

- Take advantage of a low rate:

- Refinance Debt: A low interest rate is a great time to refinance into higher-rate loans, reducing monthly payments and the total cost of debt.

- Save on variable rate loans: Low rates offer low monthly payments for variable loans, although this comes with risk if rates rise.

- Plan for big purchases: Low rates reduce the cost of big purchases, like homes or vehicles.

- Managing a rate hike:

- Opt for fixed rates: In times of expected increases, securing a fixed rate protects against future increases.

- Reduce variable debt: Reducing or paying off variable rate debt can lessen the impact of increases on your budget.

- Plan a strict budget: Anticipate potential increases in your monthly payments and adjust your spending accordingly.

Here is a chart showing the impact of interest rate changes on different types of loans: mortgage, auto, and personal.

- Low key rate : Encourages borrowing, reducing interest costs and stimulating spending.

- High key rate : Slows down borrowing, increasing interest costs and reducing expenses.

This chart highlights the contrasting effect of low and high rates, underlining the importance of adopting strategies adapted to economic conditions.

In summary

The key rate announcements and their importance

In 2025, getting the best interest rate for a car loan can seem complex, especially with economic fluctuations and the different offers from financial institutions. This is where Prêt Auto Québec steps in as a trusted partner to simplify the process and maximize your benefits.

1. A vast network of financial partners

Prêt Auto Québec works with a wide range of financial institutions, including banks, specialized lenders such as Industrial Alliance, Eden Park, Iceberg, Advantage Scotia, Lendcare, and specialized divisions such as TD Specialized. Thanks to this network, we can offer you competitive rates adapted to your profile, whether you have excellent credit or financial challenges to overcome.

2. Solutions adapted to all types of credit

We understand that every customer is unique. Whether you have good credit, bad credit or are in a situation of second chance, third chance or fourth chance credit, Prêt Auto Québec finds personalized solutions. We analyze your situation to identify the best possible options, even under high interest rate conditions.

3. Expert negotiation to get you the best rate

With our market expertise and knowledge of financial institutions, we negotiate on your behalf to obtain the lowest possible interest rate. We leverage our experience and negotiating power to offer you advantageous conditions.

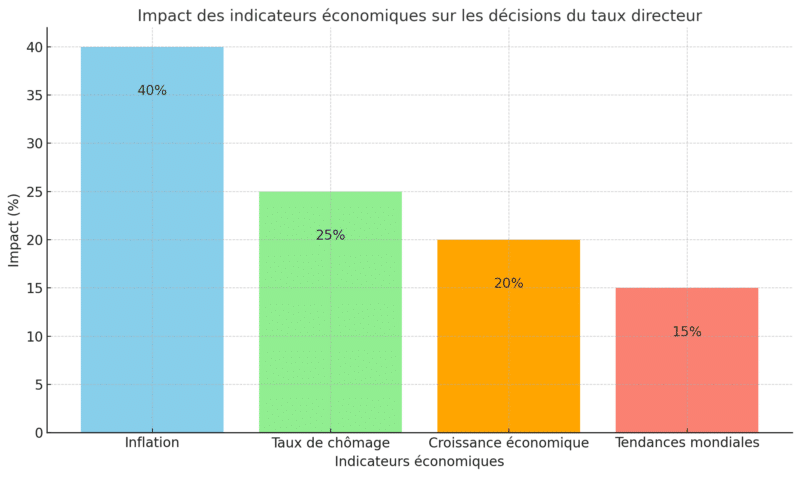

4. An understanding of market trends

Interest rates are influenced by several factors, such as politics (including economic impacts related to figures like Donald Trump), the key rate, the state of the economy and inflation. At Prêt Auto Québec, we monitor these trends to advise you at the right time, allowing you to take advantage of the most favorable conditions.

5. A transparent and simple approach

Our mission is to make the financing process simple and transparent. We clearly explain the available offers, repayment terms and total costs associated with your loan, so you can make an informed decision.

Why choose Prêt Auto Québec?

- Local expertise: We understand the specific needs of Quebecers and have in-depth knowledge of the province’s financial institutions.

- Speed and efficiency: Our team ensures that your financing request is processed quickly so that you can get back behind the wheel of your vehicle without delay.

- No hidden costs: We offer you complete transparency on the costs of your loan.

Conclusion

With Prêt Auto Québec, you have access to tools, advice and a network that allow you to obtain the best interest rate for your car loan in 2025. Contact us today to discuss your needs and let us guide you towards a financial solution adapted to your situation.

In summary

How Prêt Auto Québec can help you get the best interest rate in 2025 for your car loan

In 2025, getting the best interest rate for a car loan can seem complex, especially with economic fluctuations and the different offers from financial institutions. This is where Prêt Auto Québec steps in as a trusted partner to simplify the process and maximize your benefits.

1. A vast network of financial partners

Prêt Auto Québec works with a wide range of financial institutions, including banks, specialized lenders such as Industrial Alliance, Eden Park, Iceberg, Advantage Scotia, Lendcare, and specialized divisions such as TD Specialized. Thanks to this network, we can offer you competitive rates adapted to your profile, whether you have excellent credit or financial challenges to overcome.

2. Solutions adapted to all types of credit

We understand that every customer is unique. Whether you have good credit, a bad credit or that you are in a situation of second chance, third chance Or fourth chance credit, Prêt Auto Québec finds personalized solutions. We analyze your situation to identify the best possible options, even in high interest rate conditions.

3. Expert negotiation to get you the best rate

With our market expertise and knowledge of financial institutions, we negotiate on your behalf to obtain the lowest possible interest rate. We leverage our experience and negotiating power to offer you advantageous conditions.

4. An understanding of market trends

Interest rates are influenced by several factors, such as politics (including economic impacts related to figures like Donald Trump), the key rate, the state of the economy and inflation. At Prêt Auto Québec, we monitor these trends to advise you at the right time, allowing you to take advantage of the most favorable conditions.

5. A transparent and simple approach

Our mission is to make the financing process simple and transparent. We clearly explain the available offers, repayment terms and total costs associated with your loan, so you can make an informed decision.

Why choose Prêt Auto Québec?

- Local expertise: We understand the specific needs of Quebecers and have in-depth knowledge of the province’s financial institutions.

- Speed and efficiency: Our team ensures that your financing request is processed quickly so that you can get back behind the wheel of your vehicle without delay.

- No hidden costs: We offer you complete transparency on the costs of your loan.

Conclusion

With Prêt Auto Québec, you have access to tools, advice and a network that allow you to get the best interest rates for your car loan in 2025. Contact us today to discuss your needs and let us guide you to a financial solution that is right for you.

In summary

Prêt Auto Québec plays a key role in supporting consumers in the face of fluctuations in the key rate. With our flexible solutions, financing expertise and commitment to personalized service, we help our clients overcome the challenges of rate fluctuations while allowing them to obtain advantageous auto financing. No matter the market conditions, our priority is to help you get behind the wheel with confidence.

Get your car loan now.

We can help you.

To reach us by phone, dial:

info@www.pretautoquebec.ca