Car broker

Car broker. A car broker is your valuable ally in the process of purchasing or financing a vehicle. As an intermediary between you and dealers or lenders, the broker simplifies your process by finding the best options adapted to your needs, whether for a new or used vehicle, or customized financing. Whether you have an excellent credit record or financial challenges, the car broker saves you time and money and guides you towards optimal solutions to take the wheel with complete peace of mind.

18+

Partner financial institutions.

1000+

What is a broker?

1. Definition and role of a car broker

A car broker is a specialized professional who acts as an intermediary between the buyer of a vehicle and dealers, sellers or lenders. Their main role is to simplify the process of buying or auto financing of a car by researching, negotiating and obtaining the best options for their clients. Unlike a traditional salesperson, a broker works for the client and not for a single brand or dealership.

The main roles of a car broker include:

- Customer Needs Analysis: Assess preferences, budget, and the specific constraints of the buyer.

- Personalized search: Find vehicles matching the customer's criteria among a large network of dealers or sellers.

- Negotiation: Obtain the best possible price and the most advantageous financing conditions.

- Support: Assist the client with all administrative procedures, such as signing contracts or registration.

2. Difference between a car broker and a dealer

Although both are involved in vehicle sales, their functions and objectives differ significantly. See the chart for more information.

3. Why use a broker to purchase a vehicle?

Hiring a car broker offers several benefits for buyers:

- Save time: The broker takes care of all the steps, from research to negotiation, saving you hours of research and discussions.

- Saves money: With market knowledge and negotiating power, a broker can obtain more competitive prices and financing rate advantageous.

- Wide selection of vehicles: Brokers have access to an extensive network of dealers and sellers, increasing your chances of finding the ideal vehicle.

- Support for complex situations: Brokers specialize in solutions for clients with a damaged credit or low purchasing power, working with various lenders to offer tailored solutions.

- Complete support: From vehicle search to delivery, a broker guides you through each step, simplifying the process and reducing administrative hassle.

In summary

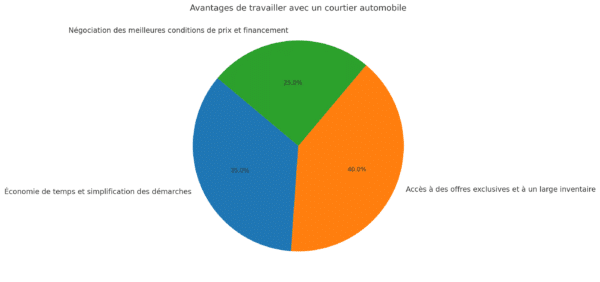

Using a car broker to purchase or finance your vehicle offers many advantages, from simplifying the process to obtaining exclusive offers. Here is a detailed overview of the main benefits.

1. Save time and simplify procedures

Buying a vehicle can be a complex and time-consuming task, involving research, dealership visits, and negotiations. A car broker makes this process much simpler:

- Personalized search: The broker takes care of finding vehicles that precisely match your criteria (make, model, budget, options, etc.), avoiding hours of research online or in dealerships.

- Administrative support: He manages the formalities related to the purchase, such as negotiation, signing of contracts, registration and sometimes even delivery of the vehicle.

- Turnkey service: You can focus on your priorities while the broker takes care of everything, from research to closing the transaction.

2. Access to exclusive offers and a large inventory of vehicles

One of the main assets of a car broker is its extensive network of partners and dealers, which allows it to offer:

- A diversified inventory: Unlike a dealership limited to a single brand or specific stock, the broker has access to a wide range of new and used vehicles from several brands.

- Exclusive offers: Thanks to its relationships with dealers, it can access promotions or vehicles that are difficult to access for the general public.

- Customized Options: Whether you are looking for an economy car, a spacious SUV or a premium model, the broker can find an option that perfectly fits your needs.

3. Negotiation of the best price and financing conditions

A car broker is an expert in negotiation, capable of obtaining advantageous conditions for his clients:

- Competitive Pricing: He can negotiate a lower price than the general public due to his experience and connections in the automotive industry.

- Advantageous financing: The broker works with several financial institutions to find competitive interest rates and options that fit your financial situation, even if your credit is damaged.

- Cost Reduction: It can also identify and reduce hidden or unnecessary costs (administration fees, unnecessary additional guarantees, etc.).

In summary

How does a car broker service work?

Using a car broker means benefiting from personalized support and expertise at every stage of the vehicle purchase or financing process. Here's how the service works, from needs analysis to vehicle delivery.

1. Key steps: From needs analysis to vehicle delivery

The role of the car broker begins with a thorough understanding of your needs and ends when you take possession of your vehicle. Here are the key steps:

- Needs analysis: During the first consultation, the broker assesses your preferences, your budget, and your constraints, such as the type of vehicle, the intended use (family, professional, urban, etc.), and the desired options.

- Search for the ideal vehicle: Using its extensive network, the broker identifies vehicles that precisely match your criteria.

- Negotiation: The broker works directly with dealers or sellers to negotiate the best price and most advantageous terms for you.

- Preparation of documents: Once the vehicle has been chosen, the broker guides you through the administrative procedures, such as signing the contract, registration, and insurance.

- Vehicle Delivery: Some brokers even offer a delivery service directly to your home or location of choice, making the process even more convenient.

2. Personalized search based on customer criteria

A car broker stands out for his ability to carry out tailor-made research:

- Large inventory: Thanks to its connections with several dealers, it has access to a vast selection of vehicles, new or used, which are not always available to the general public. Visit our inventory.

- Respecting customer preferences: Whether you are looking for an economical car, a spacious SUV or a hybrid/electric option, the broker identifies the best matches.

- Adaptability: If you are on a tight budget or have specific requirements, such as financing in 2nd chance, 3rd chance Or 4th chance credit, the broker adjusts his research to find a solution that suits you.

3. The role of the broker in administrative and financing procedures

The car broker also simplifies all the often complex procedures associated with purchasing or financing a vehicle:

- Document Management: Takes care of preparing and checking all necessary papers, such as the sales contract, registration, and insurance.

- Access to financing: The broker works with several financial institutions to find the best loan options suited to your financial situation. This includes solutions for clients with damaged credit or low purchasing power.

- Transparency: It clearly explains the terms of the financing, such as interest rates, repayment terms, and possible fees, to avoid any surprises.

In summary

A car broker for complex financial situations

A car broker is a valuable ally for clients facing financial challenges, such as damaged credit, a low down payment or financing refusals by traditional institutions. Thanks to his expertise and his network of financial partners, the broker can find solutions adapted to the most complex situations, while offering personalized support.

1. Solutions for customers with damaged credit or low down payment

People with a bad credit history or budget constraints often run into obstacles when trying to get a car loan. Here's how a car broker can help:

- Analysis of the financial situation : The broker evaluates your repayment capacity taking into account your income and expenses, beyond your credit rating.

- Finding suitable solutions: Even if you have a background such as a bankruptcy, a consumer proposal or some late payments, the broker works to find a viable offer.

- Flexibility of options: If you cannot provide a down payment Importantly, the broker can negotiate loan terms that compensate for this shortcoming while remaining accessible.

2. Financing in 2nd, 3rd or 4th chance credit thanks to financial partners

Auto brokers have access to a wide range of lenders who specialize in alternative financing, often referred to as 2nd, 3rd or 4th chance credit. Here’s how it works:

- Lender Network: Unlike traditional financial institutions, these lenders focus less on credit score and more on the customer's current financial stability.

- Accessible loan terms: Solutions offered include risk-appropriate interest rates, flexible terms and amounts adjusted according to needs.

- Complete support: The broker guides you through the steps to build a solid file, thus maximizing your chances of approval.

- Financial Education: Some brokers offer advice to help you improve your credit file and regain control of your finances.

3. How a Broker Can Help Overcome Financing Refusals

Financing denials are common for customers with poor credit or complex financial situations, but a car broker can turn these challenges into opportunities:

- Personalized assessment: A broker analyzes the reasons for the refusal, such as a debt too high, a low credit score or history of bankruptcy, and develops strategies to overcome these obstacles.

- Access to flexible lenders: Thanks to its connections, the broker can direct you to institutions that accept profiles often refused by traditional banks.

- Negotiating Alternatives: If a direct loan is difficult to obtain, the broker can explore other options, such as short-term loans, installment plans or co-borrower-based solutions.

- Gaining confidence: By acting as an intermediary, the broker simplifies communication with lenders and strengthens their confidence in your ability to repay.

In summary

Why choose Prêt Auto Québec as your car broker?

Prêt Auto Québec stands out as an essential choice for consumers who want to purchase or finance a vehicle with complete peace of mind. Thanks to its expertise, its extensive network and its tailor-made solutions, Prêt Auto Québec simplifies and optimizes each step of the process to meet the needs of all its customers, regardless of their financial situation.

1. Expertise and personalized support for each client

Quebec Auto Loan places the customer at the heart of its priorities by offering a personalized service that takes into account the specific needs and constraints of each person:

- Detailed needs analysis: Our experts take the time to understand your situation, your objectives and your preferences to offer you suitable solutions.

- Support throughout the process: From finding the ideal vehicle to negotiating financing, we guide you through each step to simplify your procedures.

- Support for complex situations: Whether you have damaged credit, a low down payment or specific needs, we find options that meet your expectations. With Prêt Auto Québec, you benefit from a human and caring service, designed to allow you to buy your vehicle without stress.

2. Partnerships with more than 20 financial institutions and a large network of dealers

One of Prêt Auto Québec's major assets is its access to an extensive network of partners, guaranteeing varied and competitive options:

- Wide Range of Lenders: By working with over 20 financial institutions, we can find great interest rates and flexible financing terms, even for customers with a difficult credit history. We have private lenders and possibilities of auto home financing.

- Access to a vast inventory: Through our network of dealers and sellers, we offer a selection of new and used vehicles in all categories, including economy cars, SUVs, trucks and electric vehicles.

- Exclusive offers: Our partnerships allow us to access special promotions and financing solutions that are not always available to the general public.

3. Flexible solutions to suit all budgets and situations

Prêt Auto Québec specializes in tailor-made financing solutions to ensure that everyone can obtain a vehicle, regardless of their financial situation:

- 2nd, 3rd and 4th chance credit financing: We work with specialized lenders to approve files often refused by traditional banks.

- Low Down Payment Options: If you're on a tight budget, we offer tailored financing plans to make it easier to afford a vehicle.

- Payment Personalization: Our experts develop repayment plans tailored to your capabilities, ensuring realistic and stress-free monthly payments.

- Support to Improve Your Credit: By choosing a well-structured auto loan, you can rebuild your credit history while enjoying your new vehicle.

In summary