Car loan.

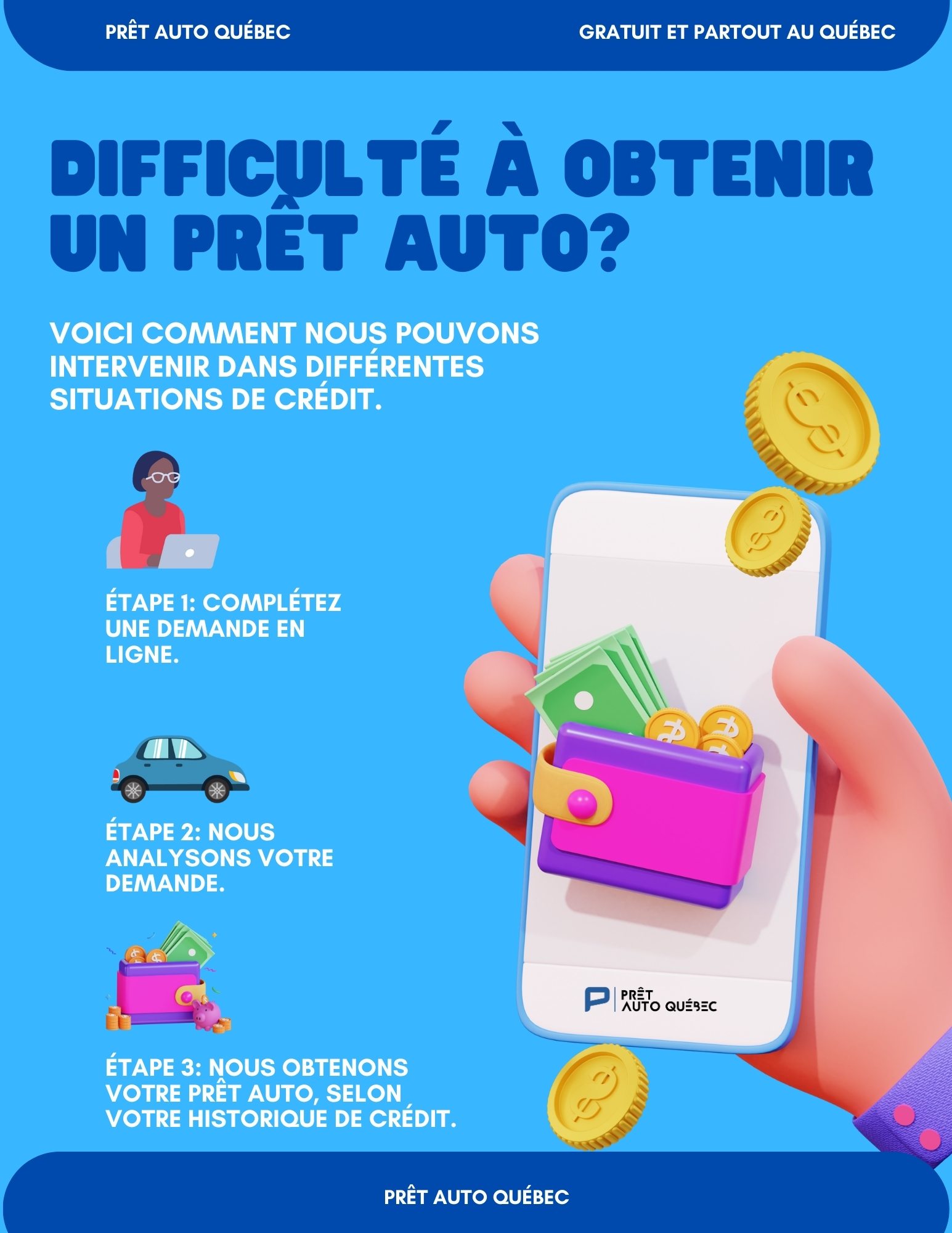

At Prêt Auto Québec, we offer flexible financing solutions, including options for those who need 1st, 2nd, 3rd, and even 4th chance credit. This means that even if you have had financial difficulties in the past or your credit history is less than perfect, you still have the possibility of obtaining financing for the purchase of your vehicle.

Get pre-approved

Fast, confidential and everywhere in Quebec

Get the best market conditions

More than 15 partner financial institutions

1st, 2nd, 3rd and 4th chance credit. Home financing available.

With or without down payment

More than 1000 vehicles in inventory

Good credit, no credit, newcomer, bad credit, voluntary surrender, bankruptcies, proposal, default, etc.

Auto financing from Prêt Auto Québec, explained in video.

When it comes time to purchase a vehicle, auto financing can be an attractive option for those who want to spread the cost of purchase over a longer period of time. Whether you need a first, second, third or even fourth chance at credit, Prêt Auto Québec is here to support you. With a simple process and tailor-made solutions, we strive to make purchasing your next vehicle as easy as possible.

By working with an extensive network of financial partners, we are able to find financing options that meet your specific needs and financial situation. Whether you have good credit or a more difficult history, we are here to help you find the right car loan for you.

Get your car loan at the best conditions on the market.

Looking for the perfect financing to make your new car purchase a reality? Look no further! At Quebec Auto Loan, we are determined to offer you the best conditions on the market for your car loan.

Our team of dedicated professionals are here to guide you every step of the way, ensuring a seamless and hassle-free experience. Through our privileged relationships with various financial partners, we are able to offer you advantageous terms, tailored to your unique situation.

Get your car loan quickly and easily, while taking advantage of the most competitive rates. We understand the importance of finding financing that perfectly aligns with your needs and your budget, which is why we do everything we can to offer you tailor-made solutions.

Choose peace of mind by choosing our team. Get your car loan at the best conditions on the market and get behind the wheel of your new car with complete confidence. Contact us today to start your automotive project with confidence and ease.

Auto financing, according to your credit file, anywhere in Quebec.

No matter where you live in Quebec, easily get your car loan with us. We make car financing accessible to everyone, no matter where you live in the province. Our dedicated team is ready to assist you, ensuring a simple and fast process so you can drive your new vehicle without hassle. Trust our expertise in car credit, no matter where you are in Quebec.

A car loan adapted to all credit situations.

A car loan adapted to all credit situations.

- Self-employed

- Total loss

- Entrepreneur

- Low basic income

- New arrival

- Recently bankrupt (discharged or not)

- Proposal to consumers

- Low income retiree

- No credit history

- Separated

- Divorce

- Voluntary surrender

- Vehicle seized

- Progressive indebtedness

- Accumulated debts

- Late payments

- Refused by several financial institutions

- In process with a bankruptcy trustee

- Job loss

- Unemployed with income

- No endorser

- SAAQ

- CNESST

- Social assistance

- Etc

Car financing for all makes and models.

At the house of Quebec Auto Loan, we make the dream of owning the perfect car a reality by offering accessible car financing for all makes and models. Whether you have your eyes on a sleek sedan, a spacious SUV or a fuel-efficient car, our dedicated team is here to help you make your automotive dreams a reality. With flexible options and advantageous terms, we are your trusted partner to get the financing you need, no matter what your dream vehicle is.

Gain an understanding of terms associated with auto financing.

Gain an understanding of terms associated with auto financing.

Car loan

A car loan is a type of loan provided by a financial institution or lender specifically for the purchase of a vehicle. automobile, whether it is a new vehicle or a used vehicle. This type of loan allows the borrower to borrow a sum of money for the purchase of a car, and to repay this sum as well as the interest on your car loan associated over a specified period. The repayment terms, including the amount of monthly payments and the loan term, are usually agreed upon between the borrower and the lender at the time the loan agreement is signed. The vehicle purchased often serves as collateral for the loan, meaning that if the borrower fails to repay the loan according to the agreed terms, the lender can seize the vehicle to recover the unpaid funds. Auto loans are commonly used by individuals to finance the purchase of a personal vehicle, whether it is a car, truck, or SUV.

Interest rate

The interest rate is the cost of credit or the price a borrower pays to borrow money from a financial institution or lender. It is expressed as a percentage of the amount borrowed and represents the amount of additional money the borrower will have to repay on top of the initial amount borrowed.

In the context of car loans, the interest rate is applied to the car loan amount to determine the interest that the borrower will have to pay on top of the principal amount. For example, if you borrow 10,000 $ to buy a car and the interest rate is 5 %, you will have to repay 10,500 $ in total (10,000 $ + 5 % interest).

The interest rate can be fixed or variable. A fixed interest rate remains the same throughout the term of the loan, meaning that the monthly payments remain constant. On the other hand, a variable interest rate may fluctuate based on financial market conditions, which may cause monthly payments to vary over time.

The interest rate is a key factor to consider when looking for a car loan, as it will have a significant impact on the total cost of loan and on the amount of monthly payments. It is therefore important to compare the interest rates offered by different lenders before making a borrowing decision.

Monthly payment

A payment for car financing is the amount of money that the borrower must pay periodically to the lender to repay the car financing contracted. This payment includes both the repayment of the borrowed principal (the initial amount of the loan) and the interest accrued on this principal. The payment is generally made monthly, but the frequency can vary depending on the terms agreed between the borrower and the lender. The payment amount is determined by several factors, including the loan amount, the interest rate, the term of the loan and the specific terms of the financing contract.

Down payment

A down payment for a car loan, also called deposit, is a sum of money initially paid by the borrower when purchasing a motor vehicle. This down payment reduces the total amount of the loan required to finance the purchase of the vehicle.

The down payment is usually expressed as a percentage of the vehicle's purchase price. For example, if the purchase price of a car is $20,000 and the borrower makes a down payment of $4,000, then the down payment is $20 of the purchase price ($4,000 / $20,000 = 0.20 or $20).

The down payment has several advantages:

- Loan Amount Reduction: By making a down payment, the borrower reduces the total loan amount needed to purchase the vehicle, which can lower monthly payments and interest over the long term.

- Lender Risk Reduction: A down payment reduces lender risk by providing an initial guarantee of the borrower's creditworthiness and reducing the likelihood of default.

- Improved loan terms: A larger down payment may allow the borrower to obtain more favorable loan terms, such as a lower interest rate or a shorter loan term.

It is important to note that a down payment is often required by lenders to obtain car financing, although some no down payment loans may also be available depending on the borrower's financial situation and the lender's policy.

Depreciation

Depreciation for a car loan refers to the gradual reduction of the loan balance over time through periodic payments made by the borrower. Each payment includes both the repayment of the principal borrowed and the payment of interest accrued on this capital.

At the beginning of the repayment period, a larger portion of the monthly payment goes toward interest, while a smaller portion goes toward principal repayment. However, as time goes by, the proportion of the payment that goes toward principal repayment increases, while the proportion that goes toward interest decreases. This means that the loan balance gradually decreases over time until it is fully repaid.

Amortization is typically calculated using a specific formula that takes into account the loan amount, interest rate, loan term, and payment frequency. Borrowers can also use an amortization schedule to track how their loan balance is growing and the payment amounts they need to make each month.

Amortization is a key concept to understand when purchasing a vehicle on credit because it influences the total amount the borrower will have to repay and the length of time the loan will be repaid. By understanding how amortization works, borrowers can make more informed financial decisions and plan their budget appropriately.

Loan term

Auto loan term, also called loan term or financing term, refers to the period of time during which the borrower agrees to repay the total amount borrowed, plus associated interest, to a lender for the purchase of a motor vehicle. This term is usually expressed as a number of years or months.

The length of a car loan can vary depending on several factors, including:

- Vehicle Year: Lenders may adjust the loan term based on the age of the vehicle. For example, a new vehicle may have a longer loan term, while a used vehicle may have a shorter loan term.

- Vehicle Mileage: Some lenders may consider vehicle mileage when determining loan term. A vehicle with high mileage may be associated with a shorter loan term.

- Lender Policy: Each lender may have its own criteria for determining loan term, based on its internal policies, the borrower's financial health, and other factors.

Typical auto loan terms can range from two to eight years, although shorter or longer terms may also be available depending on the borrower's needs and circumstances. It is important for borrowers to understand the financial implications of the loan term, as a longer term can result in higher interest in the long run, while a shorter term can result in higher monthly payments. By choosing an appropriate loan term, borrowers can better manage their budget and save money on the total cost of the loan.

Exchange value

There exchange value, also known as trade-in value or commercial value, refers to the monetary value of an existing vehicle when it is traded in or returned to a car dealership as part of an auto purchase or financing. This value is often determined by a variety of factors, including the vehicle's age, overall condition, mileage, market popularity, and automotive market trends.

Trade-in value plays an important role in the car financing process because it can be used in several ways:

- Down payment: If a customer wants to purchase a new vehicle and has an existing vehicle to trade in, the trade-in value of that vehicle can be used as a down payment to reduce the loan amount needed to purchase the new vehicle. A larger down payment can result in lower monthly payments or a shorter loan term.

- Purchase Price Reduction: If a customer plans to finance the purchase of a vehicle, the trade-in value of their existing vehicle can be deducted from the purchase price of the new vehicle. This reduces the total loan amount needed to finance the purchase.

- Existing Loan Balance: If a customer already has an outstanding loan on an existing vehicle, the trade-in value of that vehicle can be used to pay off any remaining balance on the existing loan. This allows the customer to start on an even footing when it comes to financing a new vehicle.

In summary, trade-in value is a key consideration when financing a new vehicle because it can have a significant impact on the amount of loan needed, monthly payments, and overall financing terms. It is recommended that buyers inquire about the trade-in value of their existing vehicle before beginning the purchase process to maximize their financing options.

Credit score

A credit score, also known as a credit score or credit rating, is a number that represents an individual's creditworthiness, or ability to repay debt. This score is calculated based on various financial factors, such as credit payment history, total debt owed, length of credit history, types of credit used, and new credit applications.

Credit scores are typically compiled by credit reporting agencies, such as Equifax, TransUnion, and Experian, using complex algorithms. They are typically expressed as a three-digit number, with score ranges typically ranging from 300 to 850, although this can vary slightly depending on the credit agency.

The impact of credit score on auto credit is significant. Auto lenders typically use a borrower's credit score to assess their risk level and determine the loan terms that will be offered to them. The higher the credit score, the less risky the borrower is considered and the more likely they are to obtain favorable loan terms, such as a lower interest rate and more flexible loan terms. Conversely, a lower credit score may result in less favorable loan terms, such as a higher interest rate or larger down payment requirements.

It is therefore essential for borrowers to maintain a good credit score by managing their finances responsibly, making payments on time, avoiding taking on too much debt, and regularly monitoring their credit report for errors. By improving their credit score, borrowers can increase their chances of getting favorable car financing and save money on the total cost of the loan.

Pre-approval

A pre-approval An auto loan is a conditional offer of financing issued by a lender before the borrower has selected a specific vehicle to purchase. To obtain pre-approval, the borrower typically submits a loan application that is then evaluated by the lender. The lender looks at factors such as the borrower's credit, income, employment, and credit history to determine if they qualify for a loan and under what terms.

The relevance of the pre-approval in the car loan lies in several aspects:

- Budget Determination: Pre-approval allows the borrower to know in advance the maximum loan amount that he or she is eligible to obtain. This helps the borrower determine his or her budget for purchasing a vehicle and focus on cars that are affordable based on his or her financial means.

- Save time: With a pre-approval in hand, the borrower can shop for a car with confidence, knowing that they have already secured a favorable financing offer. This can speed up the buying process by reducing the time spent negotiating financing on-site at the dealership.

- Knowledge of loan terms: Pre-approval provides the borrower with details about the loan terms, including the interest rate, loan term, and other terms. This allows the borrower to compare offers from multiple lenders and choose the one that best suits their needs and financial situation.

In summary, getting pre-approved for a car loan offers several benefits, including determining your budget, saving time, being able to negotiate the price, and knowing the loan terms. It is a valuable tool for car buyers looking to get the best possible financing for their purchase.

Residual value

Residual value, also known as resale value or trade-in value, is the estimated value of a vehicle at the end of the lease or finance term. It is the amount the vehicle is expected to be worth once all payments have been made and the lease or finance agreement ends.

The importance of residual value in auto financing lies in several key aspects:

- Determining Monthly Payments: Residual value is a key factor in calculating monthly payments for a car loan. The higher the residual value, the lower the monthly payments will be because more of the vehicle's total cost is deferred until the end of the contract. Conversely, a lower residual value results in higher monthly payments.

- Depreciation Risk: Residual value is often based on how much the vehicle is projected to depreciate over time. Vehicles lose value over the years due to wear and tear, age, and other factors. A higher residual value indicates that the vehicle is less likely to depreciate quickly, which can benefit the borrower in terms of future resale value.

- Impact on financing options: Auto lenders consider residual value when evaluating loan applications. A higher residual value can make a loan more attractive to lenders because it reduces their financial risk. This can translate into lower interest rates or more favorable loan terms for the borrower.

- End-of-term options: For leases, the residual value often determines the options available at the end of the term, such as purchasing the vehicle at its residual value, returning the vehicle to the dealer, or entering into a new lease.

In summary, residual value is an important consideration when financing a vehicle because it influences monthly payments, financial risk for lenders, end-of-contract options, and future depreciation of the vehicle. Therefore, it is essential to understand how residual value affects financing terms and to choose a vehicle with a favorable residual value to minimize long-term costs.

Lease

A lease is a vehicle rental agreement that allows a person, called the lessee, to use a vehicle for a specified period of time in exchange for a monthly fee. At the end of the lease, the lessee usually has several options, such as purchasing the vehicle at its residual value, returning the vehicle to the dealer, or entering into a new lease agreement for a different vehicle.

When it comes to a car loan, understanding what a lease is is important for several reasons:

- Financing Choices: Consumers often have the choice between a traditional vehicle purchase loan or a rental (lease) agreement. Understanding the differences between the two options allows consumers to choose the type of financing that best fits their needs, lifestyle and financial situation.

- Costs: The costs associated with a lease may be different than those associated with a traditional car loan. For example, the monthly payments of a lease may be lower than those of a traditional loan, but the lessee does not take ownership of the vehicle at the end of the lease. Understanding the costs associated with each option can help consumers make an informed decision.

- End-of-Lease Options: At the end of a lease, the lessee has several options, including purchasing the vehicle at its residual value. Understanding these options and the financial implications associated with each can help consumers plan ahead and make informed decisions about the future of their vehicle.

- Flexibility: Leases often offer more flexibility than traditional loans. For example, leases may allow consumers to change vehicles more frequently or opt for shorter lease terms. Understanding this flexibility can be important for consumers who have changing transportation needs.

In summary, understanding what a lease is and the implications of choosing this financing option is important when purchasing or financing a vehicle. This allows consumers to make informed decisions that best fit their needs, preferences and financial situation.

Common questions asked about auto loans.

Common questions asked about auto loans.

A car loan is a type of personal loan specifically intended for the purchase of a vehicle. The amount borrowed is repaid with interest over a specified period of time.

Car loan terms typically range from 12 to 84 months. Shorter terms have higher monthly payments but cost less in interest in the long run.

To apply for a car loan, you'll need your ID, proof of income (like pay stubs), banking information, and details about the vehicle you want to buy.

It depends on the terms of your loan agreement. Some lenders allow early repayment without penalties, while others may charge fees.

Yes, it is possible to get car financing with bad credit, but the interest rates will likely be higher. Some specialty lenders offer car loans to people with less favorable credit scores.

You can finance a used vehicle with a traditional auto loan, a personal loan, or a lease. Some dealerships also offer their own financing options for used vehicles.

To improve your credit score, pay your bills on time, reduce your existing debt, avoid applying for too many credit applications at once, and monitor your credit report regularly to correct any errors.

Yes, car loans affect your credit score. Making on-time payments improves your score, while late or missed payments can lower it.

A car loan is specifically for the purchase of a vehicle and is often secured by the vehicle itself. A personal loan is more flexible and can be used for a variety of needs, but is usually not secured by a specific asset.

Yes, using a co-signer with a good credit score can increase your chances of approval and get you better interest rates.

Financing through the dealership may offer promotional rates or more flexible loan terms. However, it is always a good idea to compare these offers with those from banks to ensure the best option.

Interest rates are determined by several factors, including your credit score, the amount borrowed, the term of the loan, the type of vehicle (new or used), and current economic conditions.

The amount you can borrow depends on your income, credit score, and ability to repay the loan. Lenders evaluate your financial situation to determine the maximum amount they are willing to lend you.

While some lenders offer no-down payment financing options, it's often beneficial to make a down payment. This can reduce the total loan amount and potentially give you access to a better interest rate.

A secured auto loan is secured by the vehicle you are purchasing, which means the lender can seize the vehicle if you fail to keep up with payments. An unsecured loan is not secured by property, but may have higher interest rates and stricter terms.

Financing options for a new vehicle include traditional auto loans, leasing, and special financing offers from manufacturers or dealers.

0 % financing means that you do not have to pay interest on the amount borrowed for a fixed term. This is often offered by dealers as a promotion to attract buyers, usually for new vehicles.

A direct auto loan is obtained from a bank or credit union before going to the dealership. A dealer auto loan is financed directly by the dealership or through its financing partners.

A car loan increases your total debt, which can affect your debt-to-income ratio (the amount of debt you have relative to your income). A high debt-to-income ratio can affect your ability to get other types of credit in the future.

Yes, self-employed and auto-entrepreneurs can get a car loan. However, you will need to provide proof of stable income, such as bank statements, tax returns, or customer invoices, to demonstrate your ability to repay.

You can use an online car loan calculator. You will need to know the loan amount, the interest rate, and the term of the loan. Monthly payments are calculated based on these factors.

Get your car loan now.

Working with over 18 partner financial institutions, we are the experts in automotive financing in Quebec. Our inventory includes over 1,000 used vehicles to meet your requirements. We offer financing solutions for 1st, 2nd, 3rd and 4th chance credit, with the possibility of using a private lender.

We can help you.

Bad credit and late payments.

Proposal and bankruptcy.

Voluntary surrender and seizure.

Refused many times.

Etc.